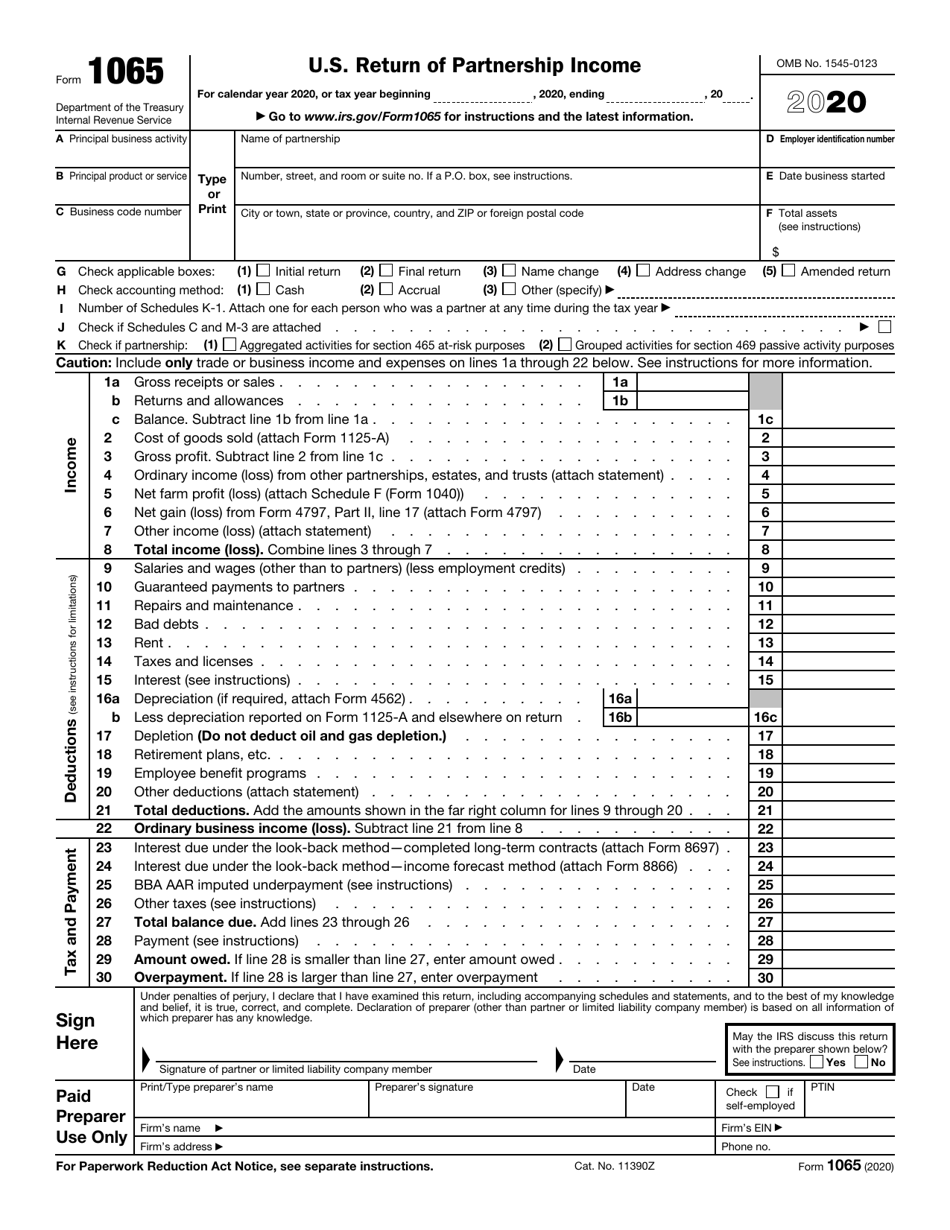

There are different regulations regarding tax filing for partnerships and sole proprietorships. If you are the only one who owns the LLC, you are required to pay tax on your profits the way a sole proprietor would. Upon officially forming an LLC, your business entity could be considered a partnership by the IRS for income tax only. These can be perused in the available IRS draft if applicable for your clients.The LLC tax return could refer to a variety of tax forms that have to be filed to the IRS when operating this legal entity. More ChangesĪ few other changes are applicable to less common situations, such as for foreign corporations with wholly owned domestic disregarded entities (DEs) and for persons required to file Form 8975 (owners of certain entities with $850 million or more in revenue). There may be action items for you to recommend to your clients now, such as determining the powers of the partnership representative. A more detailed discussion of the implications is covered here. Partnerships with 100 or fewer partners may be able to elect out if they qualify, and you should review if this option helps your client at all. The other change coming right after is of course the much talked about audit regime, as a result of the Bipartisan Budget Act (BBA) of 2015. Again, draft information should be verified on the final form. This applies to entities with less than $10 million in assets and not filing Schedule M-3. This is only relevant if you still file paper returns, but if you do, then for entities in Georgia, Illinois, Kentucky, Michigan, Tennessee, and Wisconsin there is a new filing address. This provision seems to be removed for 2017, per the draft instructions.Īnother change is in the address used where the return must be filed. Previously, receivers, trustees, or assignees, could sign the 1065, such as for a partnership filing bankruptcy. If you e-File, the corresponding signature form for 2017, 8879PE, also shows the same requirement of any partner or member for the signature, in the draft version. However, in some cases this might make the signature process easy because the passive member may be more easily available. Indeed, the passive members are unlikely to know the relevant details to help you prepare the return. Previously, a managing member was required for LLCs.

Starting with 2017 returns, per draft instructions, the 1065 return must be signed by a partner of the partnership or any member of an LLC. The first change is who can sign the return. As always, draft forms are not final, but can be used to prepare in advance for expected changes. Here are some of the key changes for 2017 for this form, from the IRS draft released in November 2017. If you file returns for partnerships or LLCs treated as partnerships, you will likely use Form 1065.

0 kommentar(er)

0 kommentar(er)